Introduction | Get Started | Learn | Practice | Apply | Explore Further | Checkpoint

Download the case study costing for at this link

When developing a costing for commercialization of a new product or service, it would be imprudent to fail to calculate the costs for design, development and marketing, and develop some expectations for market penetration and sales. This is a rational approach to the business of developing products and services. Below are the concepts discussed in Section 1, Module 2 (Costing). It is important to review your costs when you are exploring the stage of commercialization- the stage with largest budget outlay and costs.

Many firms fail to develop a consistent internal cost model, and have little understanding or knowledge of the importance of understanding the cost of acquisition, and use of a new product or service from a consumer’s point of view. Under expenditures, three important considerations have been identified, specifically, Market Research & Technical Feasibility, Product Development & Testing and Production & Market Launch.

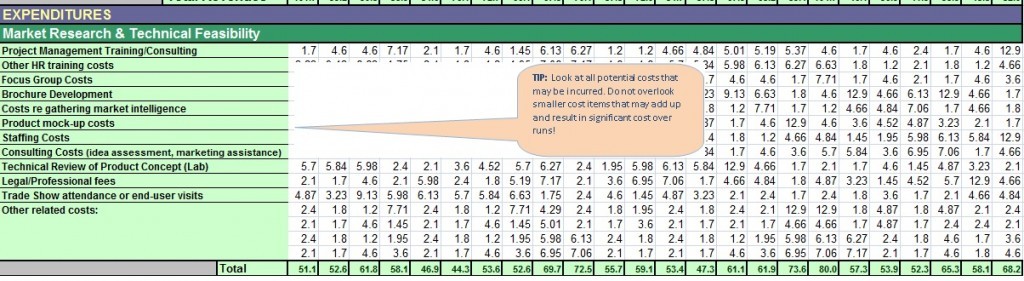

1. Market Research & Technical Feasibility costs

Market Research & Technical Feasibility costs may include Project Management Training/Consulting, Focus Group Costs, Product mock-up costs and Legal/Professional fees.

What information do I need?

- Project Management Training/Consulting

- Other HR training costs

- Focus Group Costs

- Brochure Development

- Costs re gathering market intelligence

- Product mock-up costs

- Staffing Costs

- Consulting Costs (idea assessment, marketing assistance)

- Technical Review of Product Concept (Lab)

- Legal/Professional fees

- Trade Show attendance or end-user visits

Use this section of the worksheet to estimate your Market Research & Technical Feasibility costs. In the sample below, the Market Research & Technical Feasibility costs are relatively high and at times almost half of the operating cost.

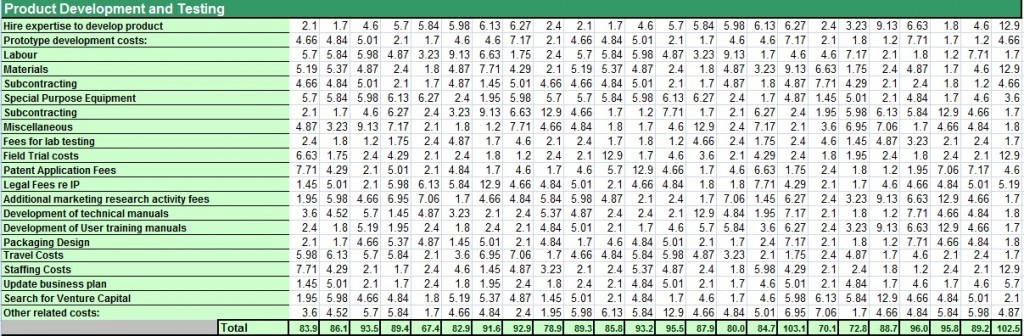

2. Product Development & Testing costs

Product Development & Testing costs relate to 19 items that could impact this area. Specifically, items such as product development costs, Materials, Subcontracting and Fees for lab testing. The product development and testing component is a critical part of the innovation process and will require added attention due to the significant impact the outcome of this stage will have on schedules, costs and the overall success of the innovation initiative.

What information do I need?

- Hire expertise to develop product

- Prototype development costs:

- Labour

- Materials

- Subcontracting

- Special Purpose Equipment

- Subcontracting

- Miscellaneous

- Fees for lab testing

- Field Trial costs

- Patent Application Fees

- Legal Fees re IP

- Additional marketing research activity fees

- Development of technical manuals

- Development of User training manuals

- Packaging Design

- Travel Costs

- Staffing Costs

- Update business plan

- Search for Venture Capital

Use this section of the worksheet to estimate your Product Development & Testing costs. Click on the image to see the sample worksheet. In the example below, the legal fees related to IP are relatively higher because of the presumed proprietary nature of the product.

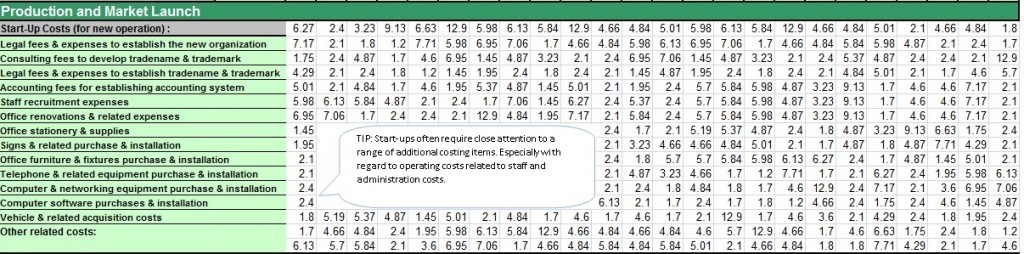

3. Production & Market Launch costs

Production & Market Launch costs include over sixty items that are clustered under four major areas of start-Up Costs (for new operation), Production Facilities, Marketing and Operating Budget (New Start-up) costs.

![]()

3a. Start up costs

The first item under Production and Market launch costs is start-up costs. It relates to a specific situations where the product is being launched by an organization in a start up phase.

What information do I need?

- Legal fees & expenses to establish the new organization

- Consulting fees to develop trade name & trademark

- Legal fees & expenses to establish trade name & trademark

- Accounting fees for establishing accounting system

- Staff recruitment expenses

- Office renovations & related expenses

- Office stationery & supplies

- Signs & related purchase & installation

- Office furniture & fixtures purchase & installation

- Telephone & related equipment purchase & installation

- Computer & networking equipment purchase & installation

- Computer software purchases & installation

- Vehicle & related acquisition costs

Use this section of the worksheet to estimate your Start up costs:

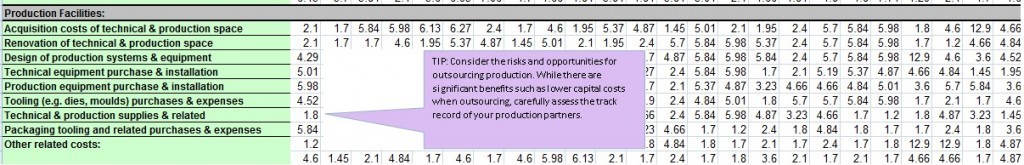

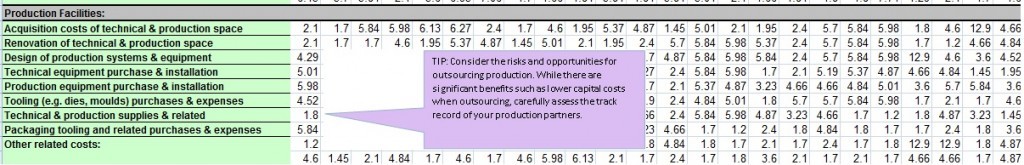

3b. Production Facilities

The benchmark for the costs related to the production facility will offer useful guidelines on whether some of the production should be managed in-house or outsourced.

TIP: Outsourcing part of the production will have a significant impact on the production space costing component and also capital costs related to production equipment.

What information do I need?

- Acquisition costs of technical & production space

- Renovation of technical & production space

- Design of production systems & equipment

- Technical equipment purchase & installation

- Production equipment purchase & installation

- Tooling (e.g. dies, moulds) purchases & expenses

- Technical & production supplies & related

- Packaging tooling and related purchases & expenses

Use this section of the worksheet to estimate your Production Facility costs:

3c. Marketing

Marketing is also a significant variable cost item due to the need for targeted strategies to increase awareness of products in specific consumer groups. Variables include PR, E-commerce, Advertising and other promotional expenses.

What information do I need?

- Marketing consulting (e.g. development of marketing tools)

- Development & negotiation of distribution arrangements

- Product market launch expenses

- Press release program expenses

- E-commerce strategy & design consulting

- Internet site development expenses

- Company &/or product brochure

- Promotional materials (e.g. product video)

- Trade show exhibit fixtures & materials

- Development and negotiation of supplier agreements

Use this section of the worksheet to estimate your Marketing costs:

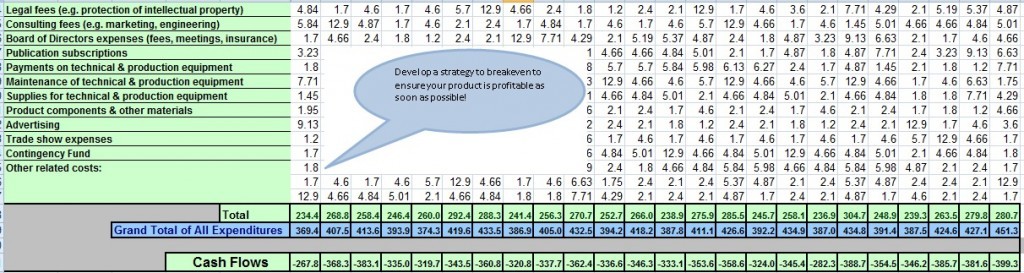

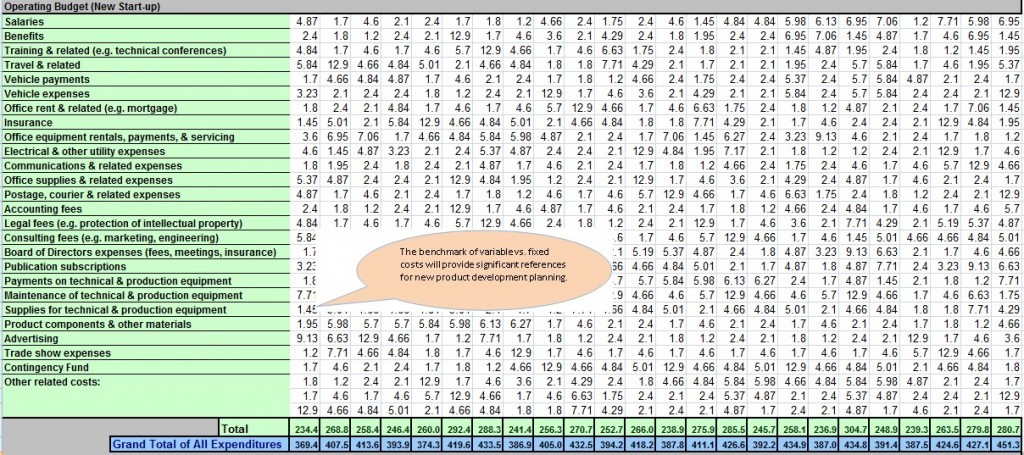

3d. Operating Budget

The operating budget consists of fixed costs such as salaries and benefits, training, utilities and legal costs. These costs need to be carefully planned and accounted for in projections as high operating costs erode the financial flexibility of an organization to redirect funds to increase resources available to innovation initiatives such as new product development.

What information do I need?

- Salaries

- Benefits

- Training & related (e.g. technical conferences)

- Travel & related

- Vehicle payments

- Vehicle expenses

- Office rent & related (e.g. mortgage)

- Insurance

- Office equipment rentals, payments, & servicing

- Electrical & other utility expenses

- Communications & related expenses

- Office supplies & related expenses

- Postage, courier & related expenses

- Accounting fees

- Legal fees (e.g. protection of intellectual property)

- Consulting fees (e.g. marketing, engineering)

- Board of Directors expenses (fees, meetings, insurance)

- Publication subscriptions

- Payments on technical & production equipment

- Maintenance of technical & production equipment

- Supplies for technical & production equipment

- Product components & other materials

- Advertising

- Trade show expenses

- Contingency Fund

Use this section of the worksheet to estimate your Operating Budget. In the example of the household cleaning product below, the operating budget is fairly stable- a good sign, indicating that it may be possible to make longer projections about the success of the innovation.

Congratulations on completing your costing summary!

Now calculate your Grand Total of All Expenditures. If your revenue is above your expenses in your calculations, that’s an excellent outcome. However, if your revenue projections are below your expenditures, as in the example of the household cleaning product below, that should not be a significant concern in the initial launch phase. Most innovation or new business initiatives incur losses in the initial years because of significant upfront investments and setting up costs.